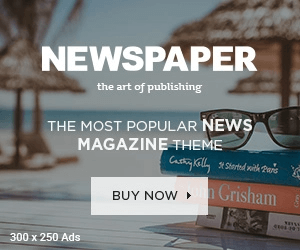

Digitalization is quickly increasing, pushed by development in AI and knowledge facilities. The IEA’s lately printed report, Power and AI, sounds the alarm on dramatic will increase in vitality demand. What you have to know is, forecasts for electrical energy consumption by knowledge facilities are extremely unsure, with some estimates far exceeding present unprecedented calls for. The U.S. is poised to guide globally in knowledge middle electrical energy consumption because of AI by 2030.

International Electrical energy Consumption Forecast (2023)—Stark Variability Between Estimates

Towards this backdrop are evolving regulatory requirements mandating vitality effectivity that present AI chips and accelerator {hardware} fails to attain. The state of Oregon proposed monetary penalties for high-power knowledge facilities and the EU’s Power Effectivity Directive mandates reporting of sustainability metrics with potential fines. The adoption of energy-efficient computing options is not optionally available. Moderately, it’s important not solely to knowledge middle operations, however for international vitality conservation.

Packaging Breakthroughs Allow Sustainability Whereas Boosting Efficiency

On the core of chip innovation are approaches that allow new entrants to compete at considerably decrease prices whereas enhancing efficiency, lowering measurement, bettering vitality effectivity, lowering manufacturing steps, and growing time-to-market. New semiconductor supplies have a downstream impression on chip efficiency:

- Pragmatic’s metal-oxide thin-film transistors (TFT) allow 75X much less space consumption and 75X decrease energy consumption. It eliminates extra inflexible packaging at lower than $1 per chip and supply inside weeks.

_ - Forge Nano developed coatings utilizing atomic layer deposition (ALD) slashing chip vitality use by 50% whereas boosting processing speeds by 40%.

_ - Nano-C’s fullerenes allow 50% decrease energy consumption for chipmakers.

Equally, different packaging supplies have an effect. Limitations lay on the front-end of the method of chip manufacturing the place the trade faces fast development in demand for differentiation in nice sample, giant space, and low-power substrates:

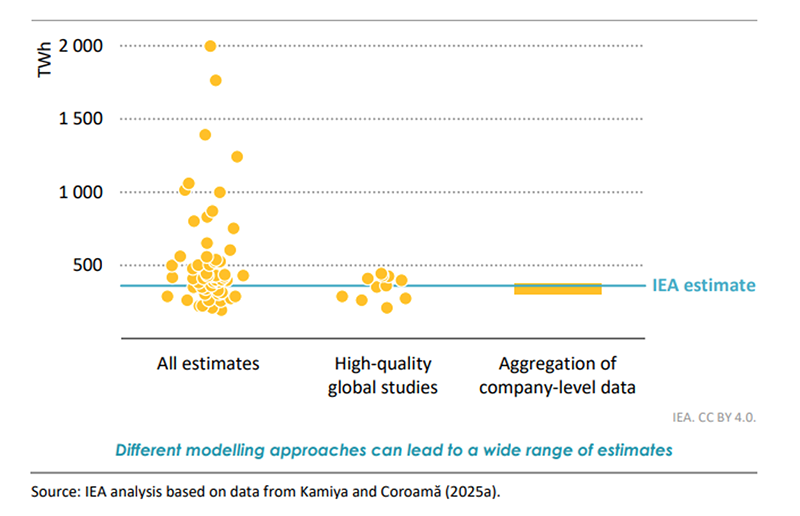

- Absolics’ glass substrates provide 30% higher energy effectivity and a 40% efficiency improve:

Illustration of Absolics’ glass substate product, inProut

- Black Semiconductor makes use of graphene and light-weight (photonics) to attach chips, promising 100X-1000X quicker processing with 60% fewer manufacturing steps.

_ - Celestial AI’s photonic cloth eliminates use of copper-based knowledge motion by as a substitute utilizing mild for info processing.

Superior packaging strategies are additionally essential. The mixing of assorted chip elements right into a single chip can scale back measurement whereas bettering efficiency.

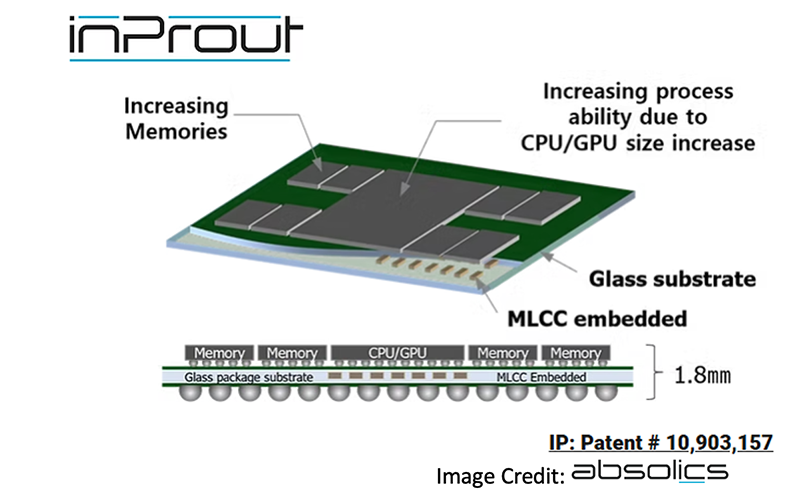

- SEMRON’s compute-in-memory chips mix processing and reminiscence capabilities right into a single unit, utilizing electrical fields relatively than currents for 50X larger vitality effectivity and 100X price discount for compute:

SEMRON’s Block Diagram

- QuInAs Know-how’s chips use compound III-Vs, demonstrating 2-3 orders of magnitude larger vitality effectivity.

_ - Lightmatter-developed silicon photonic parts allow packaging with out redesign in 50% much less space.

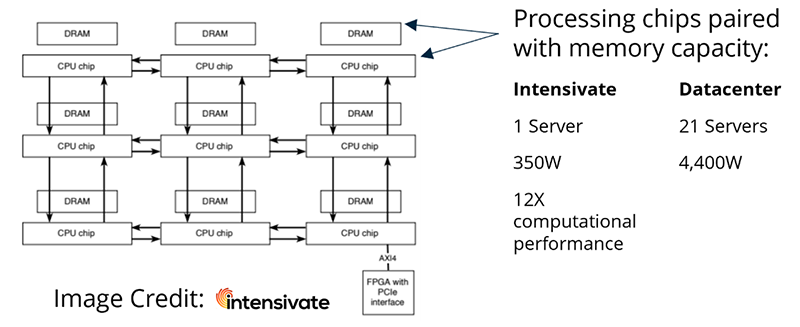

_ - Insentivate developed silicon chips that scale back electrical energy consumption by 95% in knowledge facilities, scale back rack area by 97%, and allow as much as 12X computational efficiency enchancment:

Intensivate’s Block Diagram

The shift in the direction of extra environment friendly chip applied sciences is already taking place, notably in knowledge facilities. Switching from silicon to gallium nitride (GaN) and silicon carbide (SiC) applied sciences provide >97%-99% and 98.6% vitality effectivity, respectively, in comparison with 90% for silicon. For each ten racks in a knowledge middle, switching to GaN can improve profitability by $3M yearly and scale back CO2 emissions by 100 metric tons per yr (Infineon). However switching to those applied sciences could also be difficult and costly for chip producers. Cambridge College spin-out, Cambridge GaN Gadgets, allows compatibility of GaN with present silicon manufacturing strains with out retrofitting to particular gear. Its units provide vitality financial savings of as much as 50% whereas enabling smaller units.

A Manufacturing Recession Looms—Who Wins When the Chips are Down?

The market faces important challenges, together with geopolitical tensions that threaten its complicated provide chain. Geopolitical tensions like China’s dominance over key metals and uncommon earths (like gallium) and U.S.-imposed tariffs on exports, are creating uncertainty, growing prices, and doubtlessly triggering a manufacturing recession. Chipmakers are already going through substantial losses because of tariffs, with AMD reporting a $1.5B loss in AI chip income beforehand bought to China. In Europe, the Inexperienced Deal, whereas selling sustainability, may inadvertently hinder chip innovation by growing manufacturing prices and limiting flexibility.

The market is seeing fast development pushed by the demand for AI. The worldwide income in 2024 was $627B for semiconductors. Generative AI chips already symbolize 25% of the overall superior packaging market and are projected to develop at 20% yearly over the subsequent decade (BCG). TSMC (Taiwan Semiconductor Manufacturing Firm) reported a 58% revenue improve in This fall 2024 fueled by rising AI demand, estimated to succeed in $243B in 2025 and $1T-$2T by 2030. Past AI, different sectors like automotive and Web-of-Issues (IoT) are additionally anticipated to drive income development for corporations like Qualcomm.

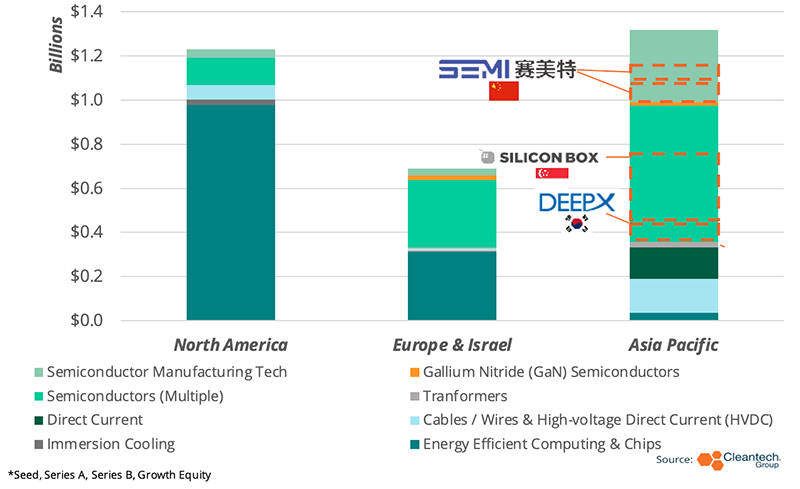

Semiconductor cleantech raised over $2.6B from 2020-2024 in non-public funding. The most important funding yr was 2023 at $1.14B in Fairness funding raised. Firms like Singapore-based Silicon Field ($100M Progress Fairness, complete close to $300M) and Korea Republic-based DEEPX ($80.5M Progress Fairness) raised a majority of funding. Pragmatic raised $231M, and Chinese language-based Tian Yu Semiconductors raised $176.7M. U.S.-based iDEAL Semiconductor acquired $40M from Utilized Supplies. There was a slight dip in funding from ’23 to ’24, nevertheless, the trade has seen an total development in a year-over-year comparability.

Enterprise & Progress Investments in Power-Environment friendly Computing Infrastructure & Elements (2022 – 2024)

Public spending can be growing, however important developments and manufacturing will increase are nonetheless missing, notably in Europe and China. The U.S. Chips and Science Act allotted $39B for manufacturing and $13.7B for analysis with ongoing discussions to extend spending. Over $8B has been awarded to huge names like GlobalFoundries ($1.5B) and Micron ($6B) to increase manufacturing within the U.S.

TSMC and Intel have shaped a three way partnership within the U.S., and Apple is planning a $500B funding in new U.S. fabs. TSMC’s complete U.S. funding has expanded to $165B, together with fabs and packaging amenities. Within the EU, The Chips Act commits $47B in the direction of semiconductors, with Infineon receiving over $1.1B and imec getting $2.7B for improvement and testing. An $11B fab three way partnership by TSMC, Infineon, Bosch, and NXP broke floor in Germany in 2024. Taiwan leads international manufacturing, with Asia-Pacific representing the biggest regional income forecast for 2025.

What’s to Come—Sooner, Cheaper, Extra Environment friendly Chips as Quickly as 2027

We’re already seeing some main startups like DEEPX and Silicon Field making important strides ahead. Consolidation of the provision chain has already begun, as superior packaging options reduce out complicated steps requiring (usually outsourced) extremely specialised labor and costly gear. Innovators have earmarked preliminary manufacturing by 2027 with some gearing up for industrial scale as quickly as 2030—market disruption is close to.

Those that fail to embrace innovation threat displacement by quicker, cheaper, and extra environment friendly chips that can trickle right down to even non-AI purposes. Rising chips are a important breakthrough in setting a powerful basis in driving the subsequent wave of innovation in AI {hardware} and elements. However these chips are usually not a silver bullet and can have restricted impacts for the trade.