There was a time, not so way back, when bugs have been being touted as the answer to meals’s emissions drawback. The logic went like this: If all of us switched from consuming cows and sheep to consuming bugs and grubs, then we’d get rid of a lot of the large methane footprint of livestock agriculture whereas additionally handily discovering a method to upcycle the sector’s huge quantity of natural waste.

Nonetheless, the marketplace for human consumption stays negligible as a consequence of cultural boundaries, perceptions round hygiene and security, and regulatory challenges.

Regardless of these hurdles, the overwhelming majority of farmed insect biomass in the present day is used as animal and aquaculture feed, with important progress potential in area of interest markets reminiscent of industrial chemical substances, biofuels, waste administration, and pet meals.

Key Advantages of Insect Farming

Insect farming affords a number of benefits over typical livestock:

- Increased Feed Conversion Ratio: Bugs convert feed into protein extra effectively than conventional livestock, utilizing a fraction of the land and water assets.

- Circularity: Farmed bugs can usually be fed solely on natural waste streams, together with byproducts from the agri-food trade.

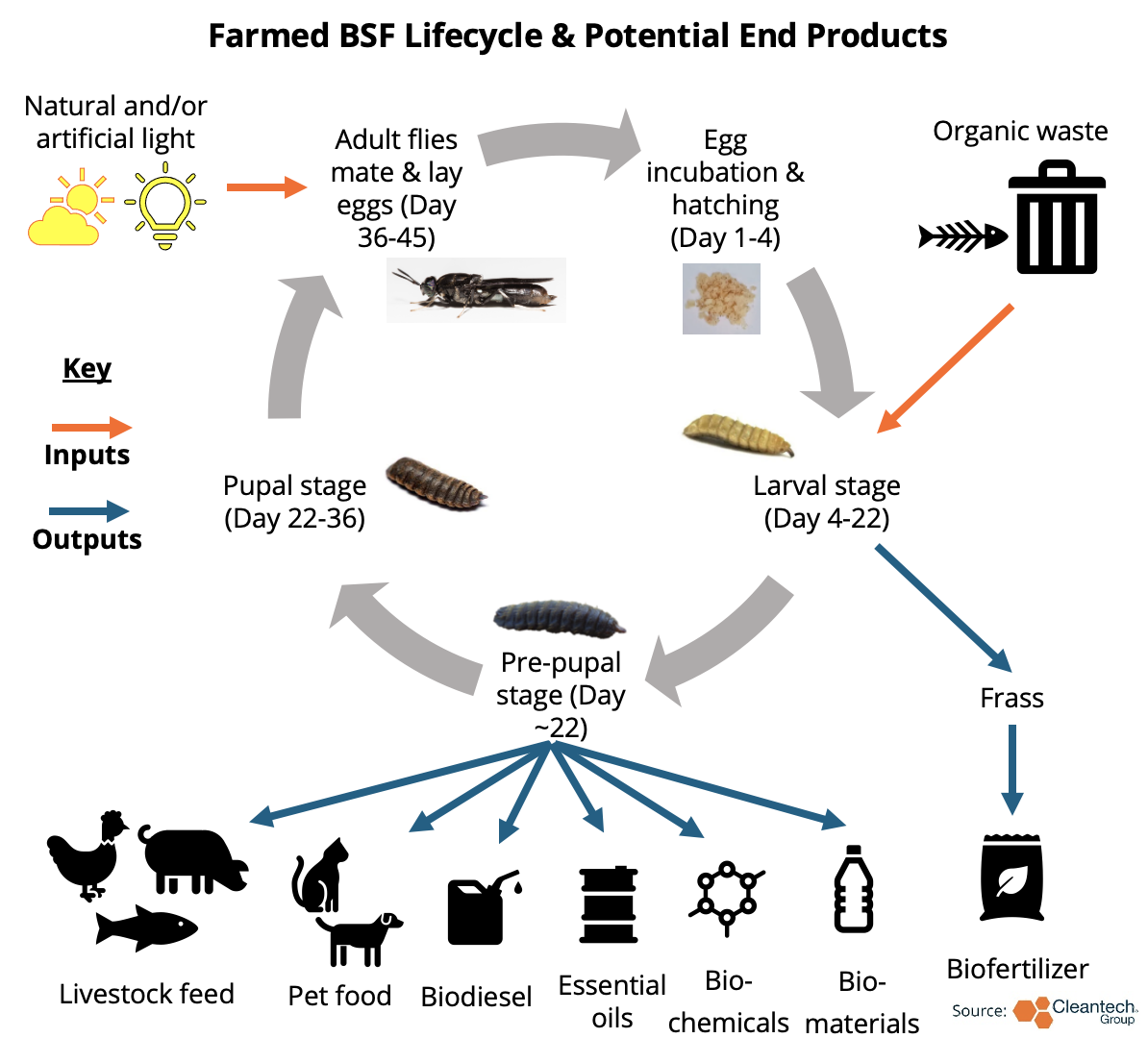

- Speedy Development: For example, black soldier fly larvae mature shortly, with 1kg of larvae yielding 0.5kg of protein in simply 2-3 weeks.

- Location Flexibility: Bugs require much less area and could be reared in managed environments, permitting bioconversion to be situated close to waste streams.

Key farmed species are black soldier fly (BSF) larvae, darkling beetle larvae (mealworms), and varied forms of crickets.

Rising Area of interest Markets

At present, about 95% of farmed insect biomass is used as feed for animals and aquaculture. This market is pushed by the necessity to substitute problematic feed parts like fishmeal and soymeal with extra sustainable choices. Though insect-based feed is barely dearer, it may be marketed as a semi-premium product as a consequence of its dietary and environmental advantages.

Whereas we will anticipate feed to stay the first vacation spot for insect biomass, there’s important progress potential in markets reminiscent of industrial chemical substances, biofuels, waste administration, and pet meals.

The latter reveals explicit promise within the close to time period, accounting for 20-25% of all meat produced, with a market worth of $121B in 2023. Pet homeowners are keen to spend comparatively extremely for his or her furry members of the family, who even have the distinct benefit of being much less discerning than their people in relation to what goes into their meals.

- Pet Meals: A rising market with regulatory approvals in key jurisdictions.

- Human Well being and Vitamin: Combined prospects, although fat, oils, and progress components for different meat manufacturing are notable areas.

- Agricultural Inputs: Frass (insect droppings and castings) could be processed into soil amendments and biofertilizers.

- Specialty Compounds and Supplies: Elevated demand for feedstocks from the biofuels and biomaterials sectors is driving renewed curiosity within the prospects of insect bioconversion; innovators reminiscent of Insectta are extracting high-value compounds from black solider fly together with chitin for medical gadgets and melanin for electronics.

Innovation and Specialization

To raised tackle these multiplying finish market alternatives, the insect farming trade is shifting away from vertically built-in, farm-based fashions in the direction of better specialization. This shift has seen the emergence of:

- Tech Suppliers: AI-driven {hardware} and software program, like that being developed by Bug Mars, can optimize breeding and rearing processes.

- Insect Genetics Corporations and Hatcheries: Companies reminiscent of BugEra use gene-editing and selective breeding to develop fascinating traits, reminiscent of greater oil content material for biofuels manufacturing.

- Modular Farm Items: Corporations like Goterra and Higher Origin supply localized waste administration options by means of plug-and-play, transport container-sized farms.

Challenges and Scalability

Regardless of the potential, scalability and sustainability stay important challenges. Some bigger gamers, like Ynsect, have confronted monetary difficulties making an attempt to scale up. Considerations about insect welfare, security, hygiene, monoculture, and the give attention to animal feed driving typical livestock manufacturing persist. Bigger-scale insect rearing is possible when co-located with feedstock and offtake, reminiscent of Innovafeed’s facility at an ADM crush plant. Additional improvement in genetics and downstream processing is required to develop promising area of interest markets, whereas additional company collaborations like that between ADM and Innovafeed, or Tyson Meals and Protix, will even do a lot to develop the trade.

Feedstock appropriateness and availability stay obstacles, notably for large-scale farms that require substantial volumes from distant areas. Moreover, there could also be cultural boundaries to insect consumption in some geographies.

One other localized inhibiting issue is the regulatory panorama. Within the U.S., the FDA has authorised sure insect species for animal feed, with additional approvals anticipated to drive funding. In 2022 the EU authorised processed bugs are authorised for pig and poultry feed, with human consumption prone to fall beneath ‘novel meals’ regulation. Earlier this 12 months the Singapore Meals Company authorised 16 insect species for human consumption.

Trying Forward

The demand for insect-based animal vitamin is about to develop as industries search extra environment friendly and sustainable feedstock choices. Pet meals is a extremely promising market, pushed by shopper demand for high-grade, wholesome vitamin for pets. The rising demand for biofuels and biomaterials is driving new enterprise fashions round high-value compounds from farmed bugs. Whereas human vitamin stays a combined market, areas with conventional entomophagy practices present higher adoption prospects.