Based on new information from TeleGeography’s Transport Networks Analysis Service, world bandwidth demand continues to climb.

However, as has been the story for the final a number of years, this progress is coming at a slower and slower price. This is what this says about long-haul networks in 2025.

Worldwide Bandwidth Demand Tendencies

Bandwidth demand progress appeared unstoppable for a very long time. As just lately as 2020, year-on-year demand elevated 45%. Quick-forward to 2024, and that tempo is right down to 29%.

Worldwide Worldwide Bandwidth Progress

Regardless of the slowdown within the annual progress price, our 2024 information represents a gradual 32% compound annual progress price (CAGR). To not point out a tripling demand between 2020 and 2024, surpassing 6.4 Pbps. That is nonetheless lots.

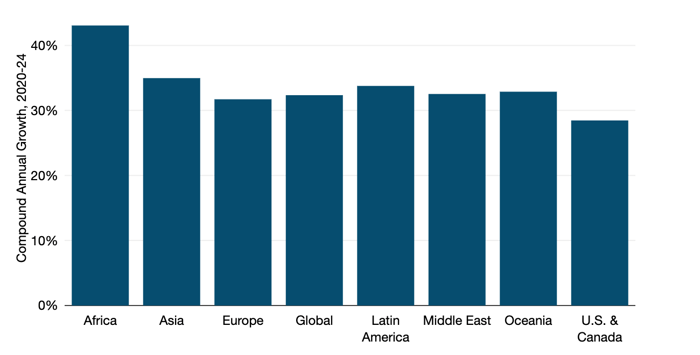

On a regional degree, most elements of the world have seen very comparable progress at about 32-35% CAGR since 2020.

Because the chart beneath exhibits, Africa outpaces different areas with greater than 40% CAGR demand progress, and the mature U.S. market falls barely beneath the typical with about 29% progress in bandwidth demand.

Used Worldwide Bandwidth Progress by Area

Supply: © 2025 TeleGeography

Supply: © 2025 TeleGeographyThe Evolving Position of Content material Suppliers

Content material and cloud suppliers—particularly a handful of corporations like Google, Meta, Microsoft, and Amazon—overwhelmingly account for many of the world’s worldwide bandwidth utilization.

As just lately as 2016, web spine suppliers accounted for almost all of demand. Not anymore. In 2024, content material and cloud networks accounted for nearly three-quarters of all bandwidth demand.

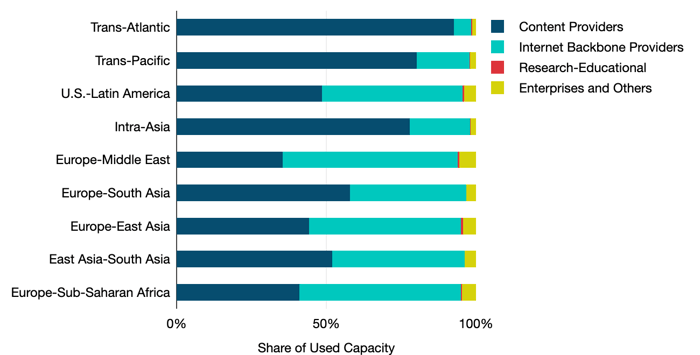

Whereas content material suppliers’ share of whole demand varies by route, it is turning into dominant nearly in all places. On the large trans-Atlantic, trans-Pacific, and intra-Asian routes, these networks account for at the least 80% of bandwidth demand.

Share of Used Bandwidth by Class for Main Routes

Notes: Knowledge exhibits used bandwidth as of year-end 2024. Supply: © 2025 TeleGeography

Notes: Knowledge exhibits used bandwidth as of year-end 2024. Supply: © 2025 TeleGeographyJust a few smaller routes, akin to Europe-East Asia and Europe-Sub-Saharan Africa, are nonetheless pushed by web spine demand, however the dynamic is shifting even in these areas.

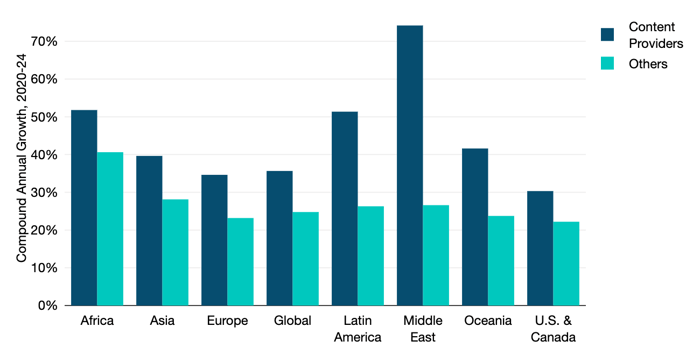

That is illustrated beneath. This chart exhibits us that content material supplier demand progress is outpacing different community sources on all the route groupings we observe.

Contemplate Latin America, the place content material demand progress is sort of double that of different sources. Throughout the subsequent yr, content material suppliers will account for the outright majority of demand on U.S.-Latin American routes.

Content material Suppliers vs. Others Bandwidth Progress by Area

Supply: © 2024 TeleGeography

As is likely to be anticipated, content material supplier demand progress is quickest in areas the place carriers are nonetheless dominant, like Africa, Latin America, and the Center East. However there is not any a part of the globe the place content material demand progress is not outpacing that of web spine suppliers.

Obtain the brand new Transport Networks Govt Abstract to maintain studying our newest evaluation on the state of worldwide community infrastructure.